Pensions still cloud Stockton bankruptcy exit

April 21, 2014 - Calpensions

With a new twist, Stocktonfs plan to leave a huge pension debt untouched was

still an issue last week as the city council, hoping to end a two-year

bankruptcy, approved settlements for 95 percent of the claims.

The settlements include Assured Guaranty and National Public Finance

Guarantee, the main opponents of Stocktonfs eligibility for bankruptcy. The bond

insurers argued that an early plan to cut bond debt, but not pension debt,

treated creditors unfairly.

Now the last major creditor that has not settled, Franklin Bonds, argues

that if Stockton exits bankruptcy without cutting pension debt, the city could

slide back toward insolvency like Vallejo.

A trial is scheduled May 12 if the city and Franklin do not reach an

agreement. While Assured and National recover most if not all of their money

under the exit plan, Franklin issued an unsecured loan and would receive $94,000

for a $37 million debt.

A Wall Street credit rating agency, Moodyfs, said in February that without

pension relief Vallejo, which emerged from bankruptcy in November 2011, and the

two cities currently in bankruptcy, Stockton and San Bernardino, risk returning

to insolvency.

Last month U.S. Bankruptcy Judge Christopher Klein

said he has seen news reports about Vallejofs budget problems and wants

to be sure that if Stockton exits bankruptcy without addressing pensions, the

city will not face a second insolvency.

Not mentioning Vallejo, Klein made a similar remark at a hearing last

November: gIf I thought there was going to have to be another Chapter 9

(bankruptcy) case in 10 years, I probably would not confirm the plan. Ifm not

sure any judge would.h

In January a deputy city manager, Kurt Wilson, was promoted to city manager

to replace the architect of the Stockton bankruptcy, Bob Deis, who retired. Deis

said pensions are needed to be competitive in the job marketplace, particularly

for police.

Vallejo officials said they considered trying to cut pension debt, but did

not after CalPERS threatened a costly legal battle. The Stockton plan eliminates

retiree health care, replacing a $546 million long-term debt with a $5 million

lump-sum payment.

gYou directed us to make sure that if we were going to endure this painful

process of bankruptcy, we were going to do it in a way that meant we would never

come back to bankruptcy,h Wilson told the council last week.

The Stockton exit plan, approved by most of the creditors, shows pension

costs rising from about 10 percent of the general fund to near 20 percent by the

end of the decade, where it remains for another decade before beginning a long

drop.

Thatfs a big bite from the budget, diverting money from services and

programs. A governorfs pension commission report in 2008 said retirement costs

were about 4 percent of most local government general funds.

In San Diego and San Jose, where voters approved sweeping cost-cutting

pension reforms two years ago, retirement costs were taking 20 percent or more

of the general funds.

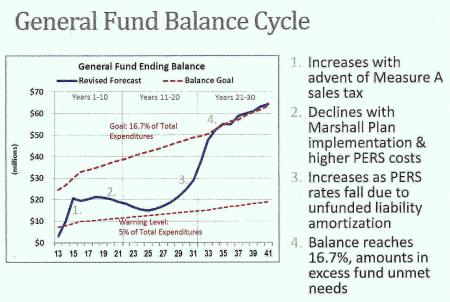

A chart in Wilsonfs presentation to the council shows that pension costs are

a main driver in projections that the Stockton general fund reserve will stay

above a warning level of 5 percent, before climbing over three decades to the

recommended goal of 17 percent.

A key part of the Stockton exit plan is Measure A, a ¾-cent sales tax

increase approved by voters in November that helps pay for the anti-crime

Marshall Plan and 120 additional police officers.

Vallejo drew attention with a $5.2 million budget gap. But officials

said the the deficit was a gplaceholderh intended to be closed by labor

cuts. The gap was closed last month, mainly through retiree health care cuts

imposed on police and negotiated with managers.

After deep police and firefighter cuts, Vallejo approved a 1-cent sales tax

increase. Now itfs building a reserve and paying down pension and retiree health

care debt. The city made an extra $6.6 million payment to the California Public

Employees Retirement System.

gWe are not on the brink of bankruptcy,h Deborah Lauchner, Vallejo finance

officer, said last month. gWe are not going there.h

Late last month Franklin

filed a report from a turnaround consultant, Charles Moore, that said

Vallejofs failure to reduce pension obligations while in bankruptcy increases

the likelihood of a second bankruptcy.

gThis presents a troubling precedent for the City (Stockton) which, like

Vallejo, proposes to squander the opportunity to restructure pension liability

in its Chapter 9 case,h said Moore.

His report said Stockton pension costs, particularly for police and

firefighters, are gvery high, growing and unpredictable.h Safety rates are

expected to reach 57 percent of pay in 2019, well above the peer average of 45

percent.

Moore said the amount of the Stockton general fund projected to be spent on

pensions, reaching 18 percent in 2018 and remaining at that level for a dozen

years, is gunsustainably high,h nearly double the 9.6 percent Stockton average

from 1999 to 2011.

Replying to Franklinfs expert, Stockton

filed a report early this month from Kim Nicholl of Segal, the

actuarial firm that made projections used in the cityfs plan to exit

bankruptcy.

He said the Franklin report did not disclose that Segal used a more

conservative annual earnings forecast than CalPERS to discount future Stockton

pension debt, 7.25 percent instead of 7.5 percent.

Nicholl said Stockton cut retirement costs by reducing salaries, requiring

employees to contribute 7 to 9 percent of pay toward their pensions and

eliminating retiree health care.

The Franklin report does not explain why the projected Stockton retirement

costs would be gunsustainably high,h said Nicholl, and does not offer any

suggestions for how pension debt could be cut.

He said if Stockton ends or cuts pension contributions, CalPERS might assess

a gmassive termination liabilityh of $1.6 billion that, if not paid by the city,

could severely reduce retiree pensions and leave active employees with no

pension.

Among the problems for Judge Klein if he looks at whether the Stockton exit

plan might lead to a second bankruptcy: Future pension costs, varying with

investment earnings and other factors, are difficult to predict with much

precision.

Federal bankruptcy courts can overturn labor contracts, as happened with an

electrical workers union contract in the Vallejo bankruptcy. But CalPERS argues

that itfs an arm of the state, and a bankruptcy court cannot interfere with

state-local government relationships.

Last week, Wilson said Stockton could emerge from bankruptcy as soon as June

30 if the judge approves the exit plan. If the plan is rejected, he said, the

bankruptcy could be extended another four to six months, delaying an exit until

the end of the year.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three

decades, most recently for the San Diego Union-Tribune. More stories are at

Calpensions.com. Posted 21 Apr 14